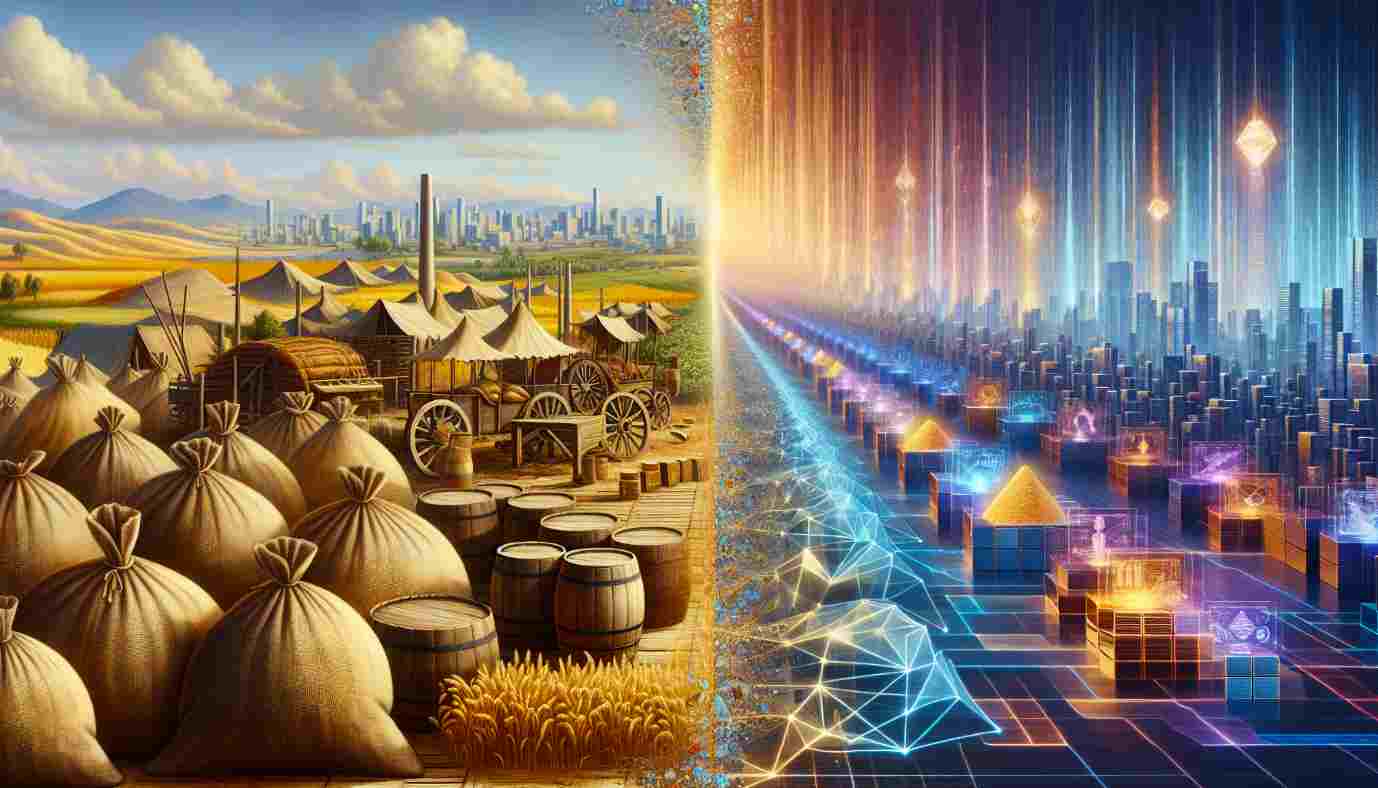

Imagine a world where the ancient marketplace’s hustle and bustle meets the cutting-edge digital landscape—a place where commodities like gold, oil and grains are traded not with a handshake but with a click. This scenario is no longer a thing of imagination. It’s the reality of how online commodity trading has reshaped the landscape of investment.

Gone are the days of shouting traders in crowded exchanges; now, anyone with an internet connection can partake in the ebb and flow of market prices from anywhere at any time. This shift has not only democratised trading but has also made it more connected to global events than ever before.

The Digital Shift in Trading

The transition from physical trading floors to sleek online platforms has not happened overnight. It’s been a gradual but sure shift that has unlocked the gates of the commodities market to all.

Now, with a few keystrokes, one can dive into the world of commodities, exploring opportunities that were once reserved for the few. The transformation is profound, allowing for more flexibility and strategic manoeuvres, as well as presenting new challenges and learning curves for those embarking on the trading journey.

As the commodity market continues to evolve, it thrives on the backbone of technology, greatly enhancing the efficiency and accessibility of trading. Digitisation has brought about a new era where algorithmic trading has become prevalent, allowing for complex mathematical models to drive trading decisions. This innovation not only streamlines the process but also introduces a level of precision that was previously unattainable in the physical trading pits.

In this pioneering environment, brokers and traders who once relied on phones and paper now wield powerful software, leveraging analytics and market insights to guide their every move.

Globalisation Influences Commodity Prices

Our ever-shrinking world, thanks to globalisation, has had a dramatic impact on industries worldwide and online commodity trading is no exception. As nations become increasingly interconnected, a drought on one continent can cause a ripple effect on commodity prices across the globe.

Traders have to remain vigilant, keeping a keen eye on international news and economic reports, understanding that a geopolitical event in one country can sway market sentiment and commodity prices halfway around the world. Indeed, globalisation’s footprint is evident as trade barriers diminish and markets integrate, fostering an environment where news travels fast, often impacting commodity prices instantaneously.

This new reality underscores the fact that traders must be equipped with a global perspective—an understanding of how international relationships, such as trade agreements or sanctions, can alter supply chains and in turn, influence commodity valuations. It’s a dynamic theatre where a trader’s ability to discern the subtleties of international trade relations can be as valuable as their technical trading skills.

Risk Management in the Modern Market

With the advent of online trading, managing risks associated with the volatile nature of the commodities market became more crucial than ever. Traders can now use a variety of tools at their fingertips—from stop-loss orders to hedging strategies—with greater ease than traditional methods allowed.

As markets move swiftly, these online tools help traders navigate uncertain waters, ensuring they’re not caught off-guard by sudden market shifts.

The Impact of Technology on Trading Strategies

Technology’s advancement has profoundly influenced trading strategies in the commodities market.

Real-time data analysis, algorithmic trading and AI-driven predictive analytics have become game-changing elements. They render traditional methods nearly obsolete, offering traders deep insights and the ability to act more quickly than ever before.

These technologies keep traders ahead of the curve, sharpening their decision-making and potentially increasing their profit opportunities.

Emerging Markets Entering the Fray

The inclusion of emerging markets into the global trading system adds a fresh layer of complexity and opportunity.

As these nations grow and develop, their demand and supply dynamics shift, offering savvy traders new avenues for trade and investment.

These markets also come with a unique set of risks, however, from political instability to currency fluctuations, necessitating a more cautious and informed trading approach.

Sustainability Reshaping Commodity Trading

In light of a global push towards sustainability, the commodities market is also transforming. Traders are increasingly attentive to the ethical implications and environmental impact of their trades.

This shift has led to the emergence of ‘green commodities’ and a movement towards eco-friendly and sustainable trading practices. The changing consumer values and regulatory landscapes are pushing traders to align with these new norms, ultimately affecting market dynamics.

Looking Towards the Future of Trading

The future of commodity trading is bound to encounter further transformations, driven by continuous innovation and technology.

From the potential impacts of blockchain to the role of artificial intelligence in market prediction, traders must be open to adapt and evolve. Maintaining a spirit of agility and willingness to learn could signify the difference between thriving and merely surviving in the burgeoning digital trading ecosystem.

As we look ahead, it’s clear that the evolution of commodity trading is not just an economic narrative but a testament to human ingenuity. The ability to blend the analytical with the technological, the historical with the futuristic, is the hallmark of today’s commodity trader. With each passing day, the market is writing new rules, inviting anyone willing to adapt and explore boundless opportunities in this digital age.